I originally posted the following information and commentary onto my Facebook wall…

IRS Losing Money on Targeting Debts of Low-Income Earners:

https://abcnews.go.com/Politics/irs-losing-money-targeting-debts-low-income-earners/story?id=56837611

(Roey Hadar) The IRS spent $20 million on private debt collectors who ultimately collected just $6.7 million, according to a report from the Taxpayer Advocate, the agency’s in-house watchdog.

The report deems the Internal Revenue Service’s work with private debt collection to be one of the agency’s most serious problems because the debts assigned to private collectors largely targeted lower-income earners who owe federal taxes.

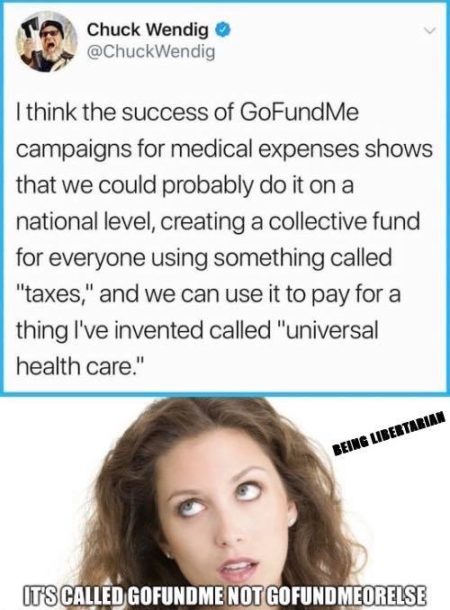

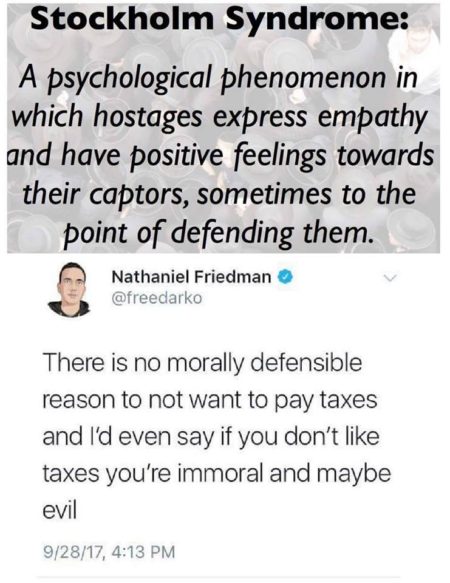

My Commentary: Taxes are the price we pay for the legalization of theft…

The corrupt institution known as the “IRS” spent $20 million in our tax dollars to hire private collection agencies to help claim “debts” owed to them, as ordered by Congress. Of course, this disproportionately effected low-income and below-poverty-level “earners,” just as the IRS predicted before implementing the legislature’s grand scheme. And, in the end, not only did the IRS only collect just a mere $6.7 million in debt, but they obviously breached the security of every single American “tax payer,” in the process, as the robo-call tax phone scams began shortly after this whole circus act started.